Call option profit formula

Scenario 4 - Seller Makes a Large Profit Selling a Covered Call Option The price of the underlying asset increases to 130 per share. Option price 10 Strike price 200 is shown below.

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

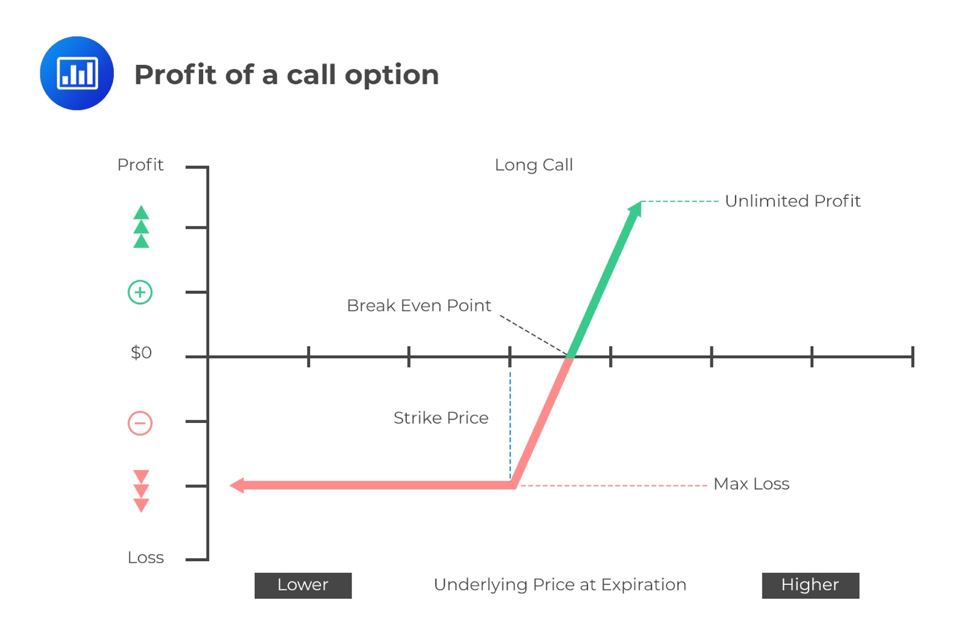

To calculate the profit on a call option take the ending price of the stock less the breakeven price of the long call and multiply the result by 100.

. This final sum represents the total profitloss. Return on Call Option Formula. 1600 - 260 1340.

The Profit at expiry is the value less the premium initially paid for the option. So if an investor had paid 260 in premiums for these options contracts the calculation would be. Lets say you can buy or write 10 call option contracts with the price of each call at 050.

The breakeven price is equal to. By now if you have well understood the basic. An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

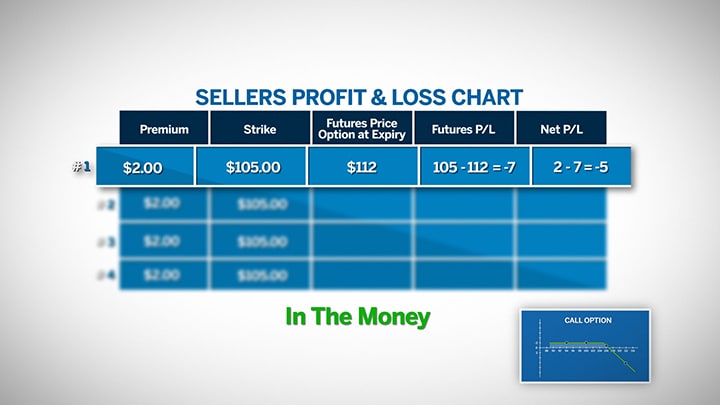

The previous examples are all from the buyers point of view. Profitloss when selling options. Probability of earning a profit at expiration if you purchase the 145 call option at 350.

The profit from writing one European call option. The calculation for the sellers profitloss is simply the negative of the buyers. Calculate the value of a call or put option or multi-option strategies.

If you set the upper slider bar to the breakeven level of 14850 this would equal the. Each contract typically has 100 shares as the underlying asset so 10 contracts would. Free stock-option profit calculation tool.

See visualisations of a strategys return on investment by possible future stock prices.

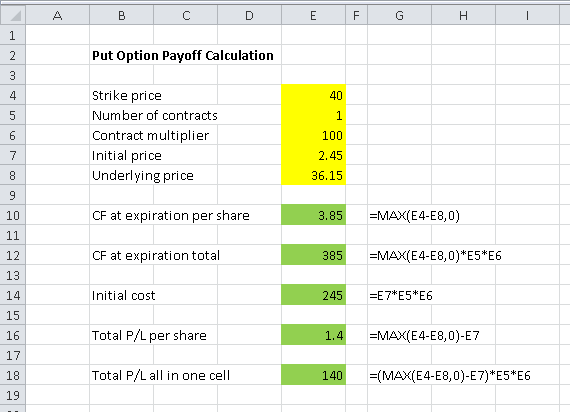

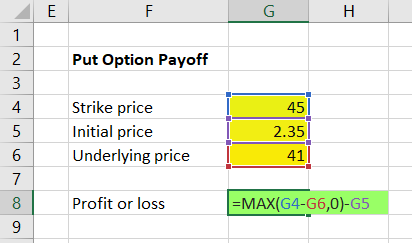

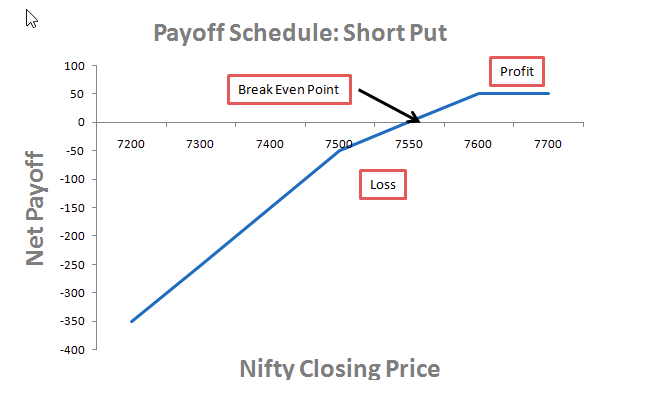

Put Option Payoff Diagram And Formula Macroption

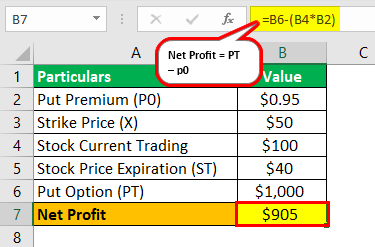

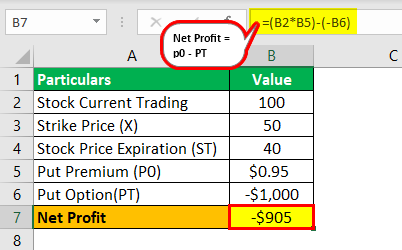

Put Options Definition Types Steps To Calculate Payoff With Examples

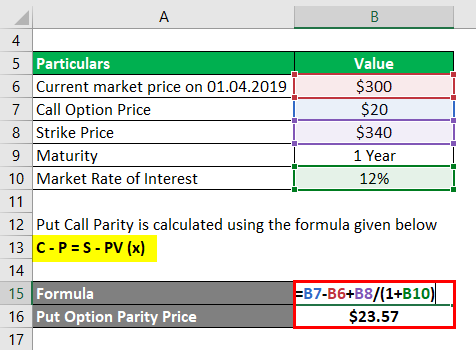

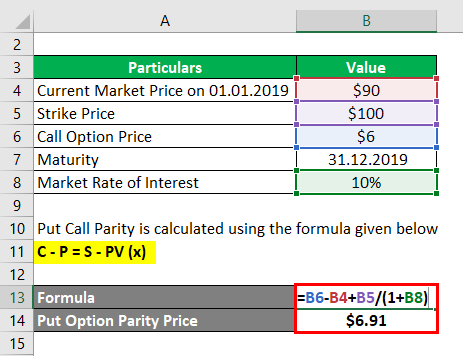

Put Call Parity Formula How To Calculate Put Call Parity

Put Call Parity Formula How To Calculate Put Call Parity

Understanding Options Expiration Profit And Loss Cme Group

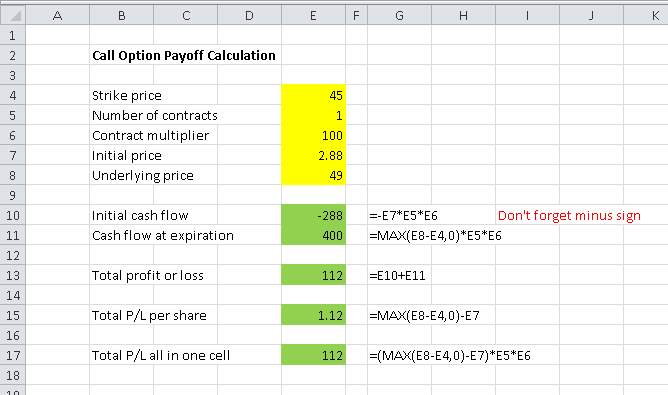

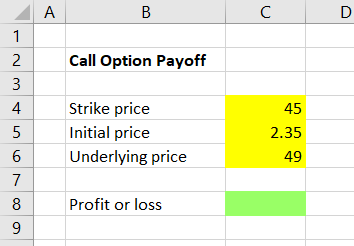

Calculating Call And Put Option Payoff In Excel Macroption

Put Options Definition Types Steps To Calculate Payoff With Examples

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes

Call Option Payoff Diagram Formula And Logic Macroption

Put Options Definition Types Steps To Calculate Payoff With Examples

Call Option Understand How Buying Selling Call Options Works

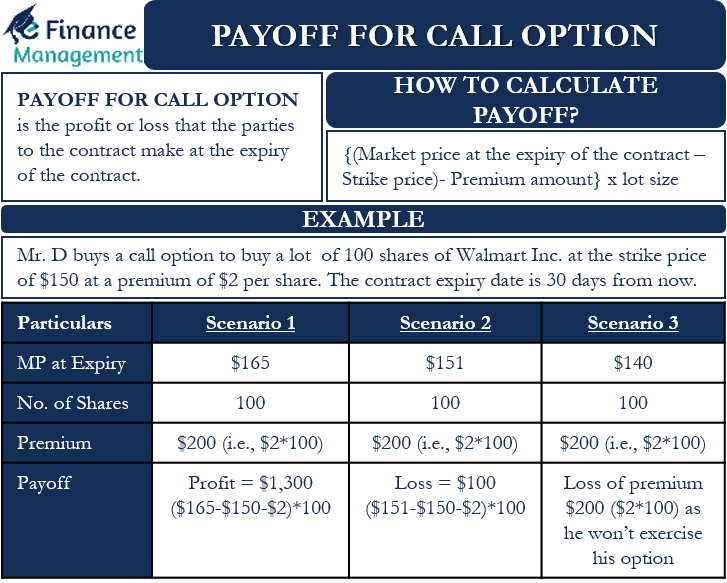

Payoff For Call Option Meaning Calculation And Examples

Calculating Call And Put Option Payoff In Excel Macroption

Call Option Calculator Put Option

Put Call Parity Formula How To Calculate Put Call Parity

Calculating Call And Put Option Payoff In Excel Macroption